Success Story Coats

Using liquidity more efficiently: cross-country cash pooling

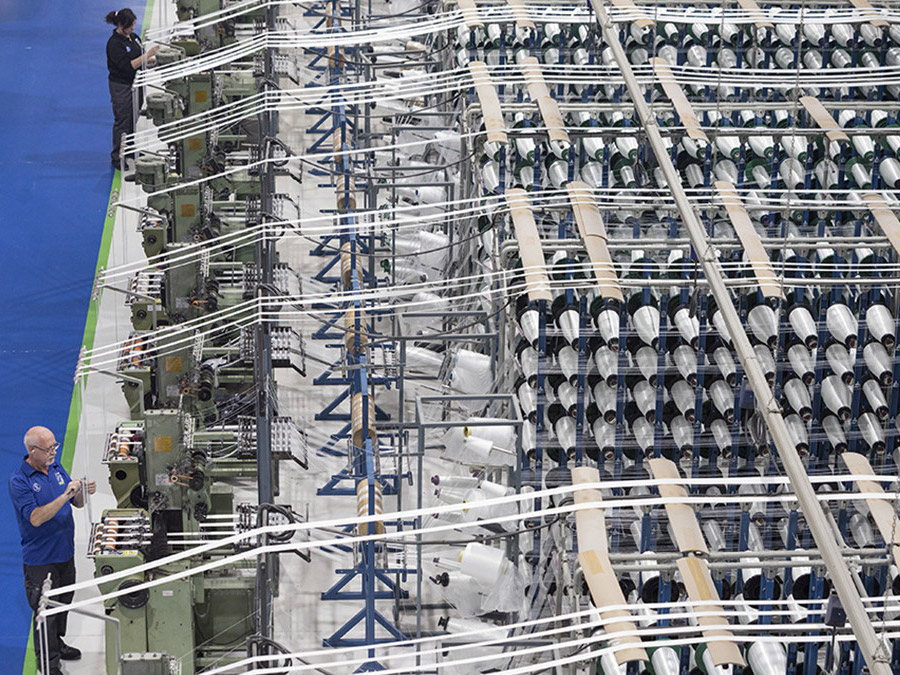

Coats is the world’s leading industrial thread manufacturer and a major player in the Americas textile crafts market. At home in some 60 countries, Coats employs 19,000 people across six continents.

The background

The heritage of Coats stretches back over 260 years to Paisley, Scotland. Its pioneering history and innovative culture help ensure it remains an industry leader today. Headquartered in the UK, it has a premium listing on the London Stock Exchange. Coats sells its products in more than 100 countries and has worked together with Commerzbank on a pan-European basis for many years – covering areas such as financing, cash management and the hedging of exchange rate risks.

The requirement

The aim of Coats was to efficiently bundle the Euro liquidity of its units in Germany, Spain, Italy, France and Poland using an automated solution. The focus lay on two aspects: the optimisation of subsidiary cash balances, to reduce outstanding debt and interest expense, and the standardisation of operations. Realising these goals meant integrating all Coats bank accounts in the relevant countries with access to all the accounts via a single banking platform.

The solution

The individual cash pooling solution created for Coats reduces the company’s workload by optimising the internal processes for account balancing in the Eurozone countries. New accounts were opened and connected to a single cash concentration structure. Straight-through processing functionality was then implemented in order to maximise operational efficiency. Success factors for the implementation included professional cooperation with Commerzbank in all participating countries and a streamlined digital exchange of information.

Today, Coats is using fully automated cash pooling to efficiently manage the liquidity of its subsidiaries in Spain, France, Poland and Italy, as well as its companies in Germany. Having established automated payments via SWIFT for German entities, the plan is to extend this to other participating companies. As part of the planned development of additional markets in Europe, Coats continues to rely on its proven cooperation with Commerzbank.