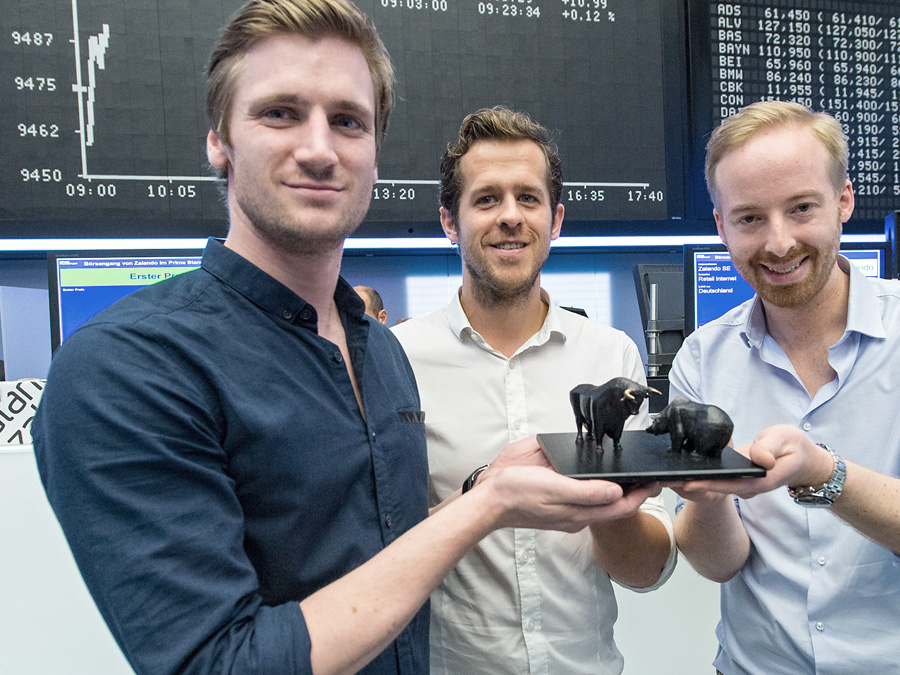

Success Story Zalando

Letters of credit – reassuring new trading partners

Zalando is Europe’s leading online platform for fashion and since 2008 has been the continent’s fastest-growing e-commerce supplier. Zalando shops are locally tailored to the needs of the clients in 15 different European markets. Their logistics network, which at present consists of four ultra-modern centres in Germany and a satellite warehouse in Italy with two further centres planned, allows Zalando to supply its clients efficiently, wherever they are in Europe.

The background

Zalando now registers a monthly average of around 160 million visits, with approximately two thirds from mobile devices. More than 10,000 employees ensure quick, easy and reliable delivery of goods to over 19 million active customers. It took just four years from Zalando’s foundation for its turnover to exceed a billion euros. The company therefore had to react quickly to expand its network of suppliers.

The requirement

During the start-up phase, it was essential to give suppliers security but without the liquidity risks associated with advance-payment orders. To achieve this, letters of credit were provided. It was also important in the early days for Zalando to familiarise its new employees with the methods used in international trade and country-specific processes.

The solution

As a newcomer to the market, Zalando was an unknown quantity as a business partner, so many fashion manufacturers were reluctant to take the risk of delivering on account. By granting of letters of credit, Commerzbank was able to support Zalando in acquiring world-renowned manufacturers as new suppliers. These letters of credit gave manufacturers security of payment. The close working relationship between Zalando’s specialist department and the team of experts at Commerzbank in Berlin was particularly helpful. Joint workshops and a reliable exchange of information ensured smooth cooperation from the very start. In view of Zalando’s ongoing high rate of growth (over 20 per cent), the business continues to rely on hedging its global commercial transactions through letters of credit.